Driving the adoption of ESG

in the Venture Capital industry.

About Us

Our Mission

in three core tenets

Stakeholder and community focused

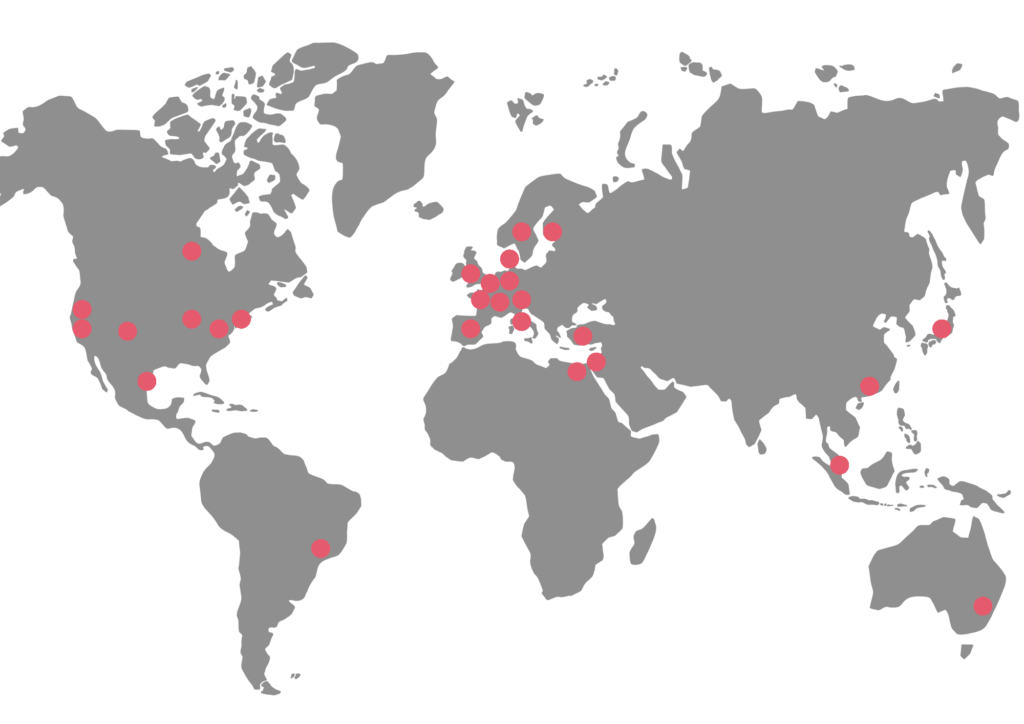

The core of our community are VC funds and LPs representing a variety of regions, stages and investment sectors.

Across steering committees, working groups, and expert-led events, we enable knowledge exchange for the collective establishment of robust ESG integration.

Fit-for-purpose tools and resources

VentureESG was born out of the frustration that existing ESG frameworks are not suitable for venture capital.

Based on the needs of our community, we develop VC-specific tools and resources with input from almost 100 experts.

From learning to capacity building

VentureESG is committed to building the right expertise across the ecosystem to prevent ESG-washing in VC.

Our ‘Leading in ESG’ training is the first step towards building up the necessary ESG knowledge within VC funds and LPs.

VC Members

For LPs

ESG adoption in venture capital is driven not only by VC funds themselves but also very strongly influenced by the requirements of the asset owners—limited partners / LPs—whose capital VCs manage.

Our separate community of 110+ LPs helps us to push for further harmonisation of ESG in VC in the medium term. Primarily through engagements with our fifteen-member LP working group, which includes top state and pension funds as well as foundations, endowments, and Fund-of-Funds in Europe and the US, we are coordinating ESG harmonisation from an LP perspective. Both the wider LP community and our LP working group meet quarterly to enable both peer exchange and standardisation of ESG reporting and practice for VCs.

We have also started to train LP investment, risk, and policy teams, starting with two prominent European state funds.

If you are interested in learning more about our LP work, please get in touch and state that you are an LP.

Our Latest News & Insights

→ Read all articles on our News & Insights page.

→ Read our research papers on our Research page.